Get Certified

Our training and certification programs.

1. Certified Member of the Board of Directors (CMBD), distance learning and online certification program. You can find the program below.

2. Certified Member of the Risk Committee of the Board of Directors (CMRBD), distance learning and online certification program. You may visit: https://www.iambd.org/Distance_Learning_for_the_Risk_Committee_of_the_Board.htm

3. Certified Member of the Corporate Sustainability Committee of the Board of Directors (CMCSCBD), distance learning and online certification program. You may visit: https://www.iambd.org/Distance_Learning_for_the_Sustainability_Committee_of_the_Board.htm

Certified Member of the Board of Directors (CMBD), distance learning and online certification program.

Overview

The board has the ultimate responsibility for the business strategy and financial soundness of an entity, key personnel decisions, governance structure and practices, risk management and compliance.

Each member of the board should exercise the “duty of care” and the “duty of loyalty” to the entity, under applicable national laws and supervisory standards. Board members should:

- actively engage in the affairs of the entity, and act in a timely manner to protect the long term interests of the entity;

- oversee the development of and approve the business objectives and strategy, and monitor their implementation;

- oversee the implementation of the governance framework and periodically review that it

remains appropriate in the light of material changes to the size, complexity, geographical footprint, business strategy, markets, and regulatory requirements of the entity;

- establish, along with senior management and the CRO, the risk appetite, taking into

account the competitive and regulatory landscape and the long-term interests, risk exposure and ability to manage risk effectively;

- approve the approach and oversee the implementation of key policies pertaining to the bank’s

risk and compliance policies, and the internal control system.

The board should be comprised of individuals with a balance of skills, diversity, and expertise, who collectively possess the necessary qualifications commensurate with the size, complexity, and risk profile of the entity.

In assessing the collective suitability of the board, the following should be taken into account:

- board members should have a range of knowledge and experience in relevant areas and have varied backgrounds to promote diversity of views. Relevant areas of competence may include, but are not limited to capital markets, financial analysis, financial stability issues, financial reporting, information technology, strategic planning, risk management, compensation,

regulation, corporate governance, and management skills;

- the board collectively should have a reasonable understanding of local, regional and, if appropriate, global economic and market forces and of the legal and regulatory environment.

- international experience, where relevant, should also be considered;

- individual board members’ attitude should facilitate communication, collaboration, and critical debate in the decision-making process.

In order to help board members acquire, maintain, and enhance their knowledge and skills, and fulfil their responsibilities, the board should ensure that members participate in induction programmes and have access to ongoing training on relevant issues which may involve internal or external resources.

The board should dedicate sufficient time, budget, and other resources for this purpose, and draw on external expertise as needed. More extensive efforts should be made to train and keep updated those members with more limited financial, regulatory, or risk-related experience.

Training and certification for board members is of paramount importance for every entity.

Objectives

The program provides with the skills needed to understand and support regulatory compliance and enterprise wide risk management. The program also provides with the skills needed to pass the Certified Member of the Board of Directors (CMBD) exam.

Target Audience

The CMBD certification program is beneficial to potential, new and sitting members of the Board of Directors.

Course Synopsis

- Introduction.

- Overlapping and inter-dependent roles.

- Management, board, shareholders, stakeholders.

- Principles, New York Stock Exchange, Commission on Corporate Governance.

- Board composition and role.

- Board duties and obligations.

- Management’s relationship with the board.

- Example, cyber risks and the Boardroom.

- Governance, risk, compliance.

- OECD principles of corporate governance.

- The Financial Stability Board's Thematic Review on Risk Governance.

- The Financial Stability Board's Thematic Review on Corporate Governance.

- Policies, procedures, baselines, guidelines, ethics.

- Conflicts of interest.

- Examples and case studies.

- Laws, standards and best practices for the Board of Directors in the USA.

- Important federal rules and regulations.

- The Securities Act of 1933.

- The Securities Exchange Act of 1934.

- The Sarbanes Oxley Act of 2002.

- The Dodd-Frank Act of 2010.

- Various SEC regulations and rules from the Federal Reserve for banks and other financial entities.

- The Sarbanes Oxley Act and the Board of Directors.

- Laws, standards, and best practices for the Board of Directors in the European Union (EU).

- European Union, legal acts after the Treaty of Lisbon.

- Delegated acts, implementing acts.

- The European system of financial supervision (ESFS).

- The European Systemic Risk Board (ESRB).

- The European Banking Authority (EBA).

- The European Securities and Markets Authority (ESMA).

- The European Insurance and Occupational Pensions Authority (EIOPA).

- 8th Company Law Directive (2006/43/EC) - From SOX to E-SOX.

- Corporate governance, auditors, audit committee.

- Directive 2014/56/EU.

- The Solvency II Directive of the European Union.

- Governance, risk, and compliance.

- Fit and proper requirements for persons who effectively run the undertaking or have other key functions.

- Case studies.

- The Basel III framework and the Board of Directors.

- The Financial Stability Board (FSB).

- Basel III, the G20 and the FSB.

- The Bank for International Settlements (BIS).

- Basel III - Corporate governance and risk management.

- A. Board practices.

- B. Senior management.

- C. Risk management and internal controls.

- D. Compensation.

- E. Complex or opaque corporate structures.

- F. Disclosure and transparency.

- The December 2017 amendment, corporate governance, and oversight.

- Closing remarks.

Become a Certified Member of the Board of Directors (CMBD)

We will send the program up to 24 hours after the payment. Please remember to check the spam folder of your email client too, as emails with attachments are often landed in the spam folder.

You have the option to ask for a full refund up to 60 days after the payment. If you do not want one of our programs or services for any reason, all you must do is to send us an email, and we will refund the payment, no questions asked.

Your payment will be received by our strategic partner and service provider, Cyber Risk GmbH (Dammstrasse 16, 8810 Horgen, Switzerland, Handelsregister des Kantons Zürich, Firmennummer: CHE-244.099.341). Cyber Risk GmbH may also send certificates to all members.

The all-inclusive cost is $297. There is no additional cost, now or in the future, for this program.

First option: You can purchase the Certified Member of the Board of Directors (CMBD) program with VISA, MASTERCARD, AMEX, Apple Pay, Google Pay etc.

Purchase here the Certified Member of the Board of Directors (CMBD) program with VISA, MASTERCARD, AMEX, Apple Pay, Google Pay etc.Second option: QR code payment.

i. Open the camera app or the QR app on your phone.

ii. Scan the QR code and possibly wait for a few seconds.

iii. Click on the link that appears, open your browser, and make the payment.

.png)

Third option: You can purchase the Certified Member of the Board of Directors (CMBD) program with PayPal

When you click "PayPal" below, you will be redirected to the PayPal web site. If you prefer to pay with a card, you can click "Debit or Credit Card" that is also powered by PayPal.

What is included in the program:

A. The official presentations (1,189 slides)

The presentations are effective and appropriate to study online or offline. Busy professionals have full control over their own learning and are able to study at their own speed. They are able to move faster through areas of the course they feel comfortable with, but slower through those that they need a little more time on.

B. Up to 3 online exam attempts per year

Candidates must pass only one exam to become CMBDs. If they fail, they must study the official presentations and retake the exam. Candidates are entitled to 3 exam attempts every year.

If candidates do not achieve a passing score on the exam the first time, they can retake the exam a second time.

If they do not achieve a passing score the second time, they can retake the exam a third time.

If candidates do not achieve a passing score the third time, they must wait at least one year before retaking the exam. There is no additional cost for any additional exam attempts.

To learn more, you may visit:

https://www.iambd.org/Questions_About_The_Certification_And_The_Exams_1.pdf

https://www.iambd.org/IAMBD_Certification_Steps_1.pdf

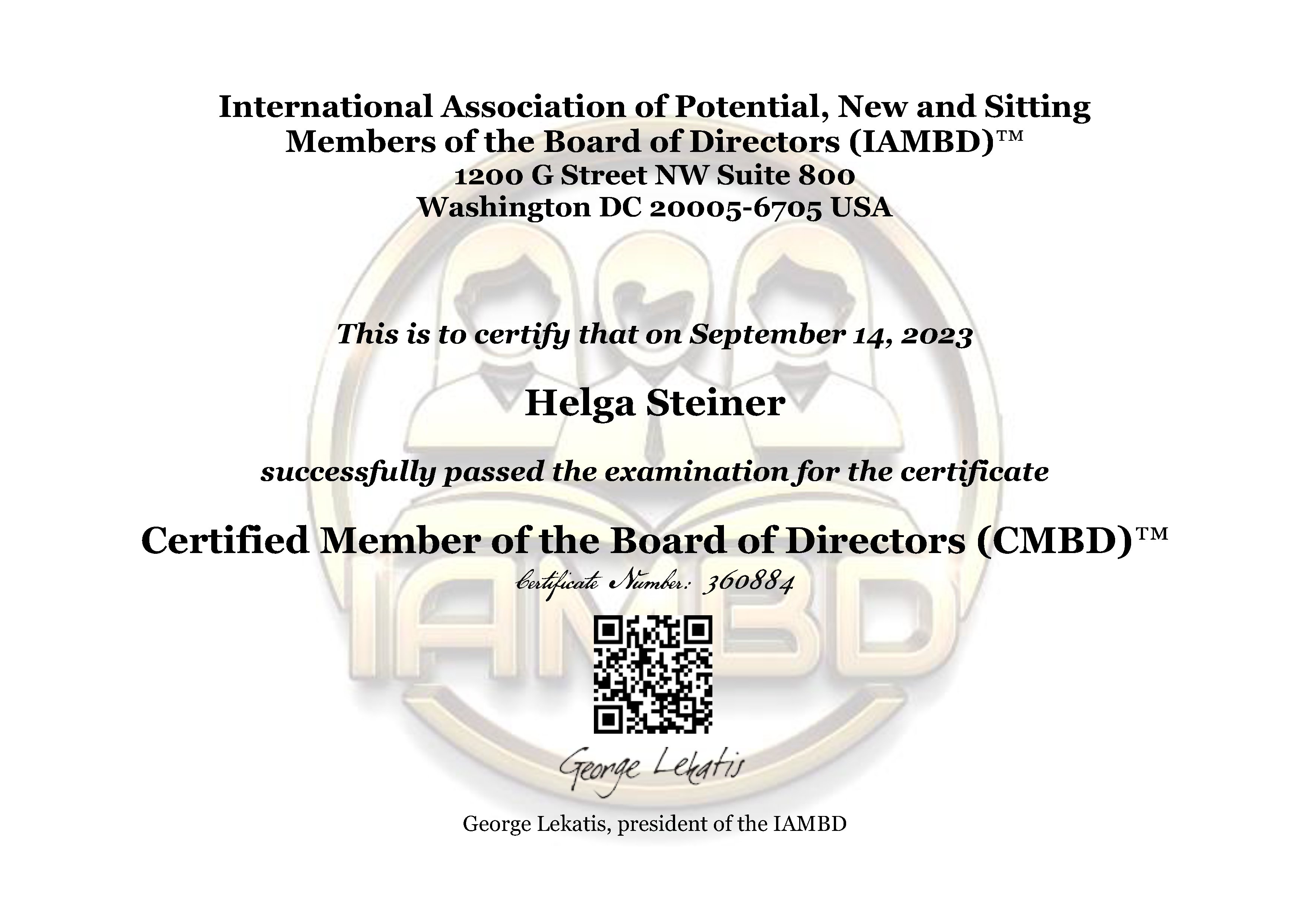

C. The Certificate, with a scannable QR code for verification.

You will receive your certificate via email in Adobe Acrobat format (pdf), with a scannable QR code for verification, 7 business days after you pass the exam. A business day refers to any day in which normal business operations are conducted (in our case Monday through Friday), excluding weekends and public holidays.

D. One web page of the International Association of Potential, New and Sitting Members of the Board of Directors (IAMBD) dedicated to you (https://www.iambd.org/Your_Name.htm).

When third parties scan the QR code on your certificate, they will visit the web page of the International Association of Potential, New and Sitting Members of the Board of Directors (IAMBD) that is dedicated to you. They will be able to verify that you are a certified professional, and your certificates are valid and legitimate.

In this dedicated web page we will have your name, the certificates you have received from us, pictures of your certificates, and a picture of your lifetime membership certificate if you are a lifetime member.

This is an example: https://www.iambd.org/Helga_Steiner.htm

Professional certificates are some of the most frequently falsified documents. Employers and third parties need an easy, effective, and efficient way to check the authenticity of each certificate. QR code verification is a good response to this demand.

Frequently Asked Questions

1. I want to learn more about the International Association of Potential, New and Sitting Members of the Board of Directors (IAMBD).

The IAMBD is wholly owned by Compliance LLC, a company incorporated in Wilmington NC and offices in Washington DC, a provider of risk and compliance training in 36 countries.

Several business units of Compliance LLC are very successful associations that offer standard, premium, and lifetime membership, weekly or monthly updates, training, certification, Authorized Certified Trainer (ACT) programs, advocacy, and other services to their members.

2. Does the association offer training?

The IAMBD offers distance learning and online certification programs in all countries, and in-house instructor-led training in companies and organizations in many countries.

A. Distance learning and online certification programs.

A1. Certified Member of the Board of Directors (CMBD), distance learning and online certification program. To learn more, you may visit: https://www.iambd.org/Distance_Learning_and_Certification.htm

A2. Certified Member of the Risk Committee of the Board of Directors (CMRBD), distance learning and online certification program. To learn more, you may visit: https://www.iambd.org/Distance_Learning_for_the_Risk_Committee_of_the_Board.htm

A3. Certified Member of the Corporate Sustainability Committee of the Board of Directors (CMCSCBD), distance learning and online certification program. To learn more, you may visit: https://www.iambd.org/Distance_Learning_for_the_Sustainability_Committee_of_the_Board.htm

B. Instructor-led training.

For instructor-led training, you may contact Lyn Spooner.

3. Is there any discount available for the distance learning programs?

Unfortunately, we do not offer any discounts. We want to keep the cost of the programs so low for all members.

4. Are your training and certification programs vendor neutral?

Yes. We do not promote any products or services, and we are 100% independent.

5. I want to learn more about the exam.

You can take the exam online in the comfort of your home or office, in all countries. You will be given 90 minutes to complete a 35-question multiple-choice exam. You must score 70% or higher.

We do not send sample questions. If you study the presentations, you can score 100%.

When you are ready to take the exam, you must follow the steps: https://www.iambd.org/IAMBD_Certification_Steps_1.pdf

6. How comprehensive are the presentations? Are they just bullet points?

The presentations are not bullet points. They are effective and appropriate to study online or offline.

7. Do I need to buy books to pass the exam?

No. If you study the presentations, you can pass the exam. All the exam questions are clearly answered in the presentations. If you fail the first time, you must study more. Print the presentations and use Post-it to attach notes, to know where to find the answer to a question.

8. Is it an open book exam? Why?

Yes, it is an open book exam. Risk and compliance management is something you must understand and learn, not memorize. You must acquire knowledge and skills, not commit something to memory.

9. Do I have to take the exam soon after receiving the presentations?

No. You can take the exam from your office or home, any time in the future. Your account never expires and there is no restriction of any kind.

10. Do I have to spend more money in the future to remain certified?

No. Your certificates never expire. They will be valid, without the need to spend money or to take another exam in the future.

11. Ok, the certificates never expire, but things change.

Recertification would be a great recurring revenue stream for the association, but it would also be a recurring expense for our members. We resisted the temptation to "introduce multiple recurring revenue streams to keep business flowing", as we were consulted. No recertification is needed for our programs.

Things change, and this is the reason you need to become (at no cost) a member of the association. Every month you can visit the "Reading Room" of the association and read our newsletter with updates, alerts, and opportunities, to stay current.

12. Why should I get certified?

After the failures of so many organizations during the recent crisis, firms and organizations hire "fit and proper" board members who can provide evidence that they are qualified.

13. Why should I choose your certification programs?

We strongly believe that we offer very good value for money:

a. The CMBD, the CMRBD and the CMCSCBD programs are unique in the market.

b. The all-inclusive cost of each program ($297) is very low. There is no additional cost for each program, now or in the future, for any reason.

c. There are 3 exam attempts per year that are included in the cost of each program, so you do not have to spend money again if you fail.

d. No recertification is required. Your certificates never expire.

14. I want to receive a printed certificate. Can you send me one?

Unfortunately this is not possible. You will receive your certificate via email in Adobe Acrobat format (pdf), with a scannable QR code for verification, 7 business days after you pass the exam. A business day refers to any day in which normal business operations are conducted (in our case Monday through Friday), excluding weekends and public holidays.

The association will develop a dedicated web page for each certified professional (https://www.iambd.org/Your_Name.html). In your dedicated web page we will add your full name, all the certificates you have received from the association, and the pictures of your certificates.

When third parties scan the QR code on your certificate, they will visit your dedicated web page, and they will be able to verify that you are a certified professional, and your certificates are valid and legitimate.

Professional certificates are some of the most frequently falsified documents. Employers and third parties need an easy, effective, and efficient way to check the authenticity of each certificate. QR code verification is a good response to this demand.

You can print your certificate that you will receive in Adobe Acrobat format (pdf). With the scannable QR code, all third parties can verify the authenticity of each certificate in a matter of seconds.